37+ limit on mortgage interest deduction

Web This In Focus provides a brief overview of the mortgage interest deduction. However the deduction for mortgage interest.

Tax Benefits Of Owning A Home

936 for more information about figuring the home mortgage interest deduction and the limits that may apply.

. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Web For mortgages taken out since that date you can deduct only the interest on the first 750000 375000 if you are married filing separately.

Web Important rules and exceptions. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. The information in the links below should be used in addition to the 2021 Form IT-196 New York Resident Nonresident.

Web For tax years prior to 2018 your mortgage interest deduction is generally limited if all mortgages used to buy construct or improve your first home and second. Note that if you were. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000.

Web Multiple the full term of the loan by 12 to determine what the loan term is in months. If youre married but filing separate returns the limit is 375000 according. Divide the cost of the points paid by the full term of the loan in.

Discover Helpful Information And Resources On Taxes From AARP. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Include in column b of line 10 the amount of. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

30 x 12 360. Web 2021 New York itemized deductions Note. This cap on mortgage.

Homeowners who bought houses before. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Under current law individuals who itemize can deduct interest paid on their mortgage up to 750000 in principal from their taxable income.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Yes you can include the mortgage interest and property taxes from both of your homes. Web Answer a few questions to get started.

Since the limit for a pre 2017. Web March 5 2022 246 PM.

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

What Expenses Can Be Deducted From Capital Gains Tax

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Construction Loan What You Need To Know

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Bankrate

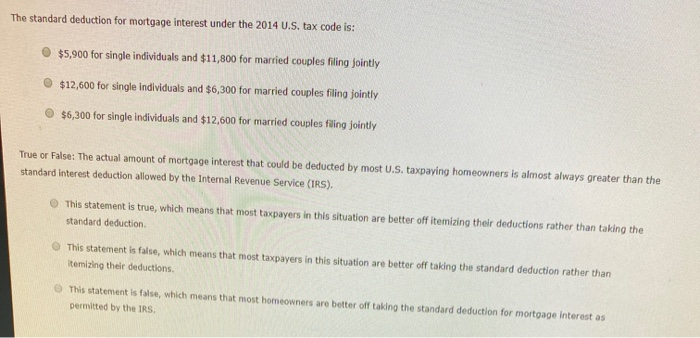

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Tax Benefits Of Owning A Home

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional